by ELENA VERNA for Elena’s Growth Scoop

Cost of Acquisition (CAC) trap.

And why you should optimize payback period instead.

MAY 12, 2023

So many acquisition-focused teams tirelessly chase after reducing Customer Acquisition Cost (CAC) or making it just one-third of the Customer’s Lifetime Value (LTV). Yet, they often find themselves disappointed with lackluster results. Because in this “money doesn’t grow on trees” economy, where every dollar counts, the real hero is the velocity of the payback period.

ROI is back, baby.

Where can CAC-reducing goals go wrong?

Many acquisition teams are mandated to lower the Cost of Acquisition (CAC). This seems like a reasonable strategy. But let’s consider two potential sources of customers:

- Channel A generates a high volume of customers with a CAC of $5.

- Channel B brings in fewer customers but has a CAC of $1000.

The immediate reaction of many would be to shut down Channel B due to its high CAC to reduce the average CAC.

But cheap acquisition is cheap for a reason. Consider that Channel B, despite its high CAC, attracts customers who convert to paid < a month, recoup their acquisition costs, and contribute significant additional expansion revenue. On the other hand, Channel A is bringing low-intent users who increase the cost of service, convert at low rates, and don’t generate enough revenue to break even within a year.

In this scenario, focusing only on reducing CAC could shut down your most profitable channel in favor of attracting accounts with low intent and poor conversion rates.

Why is optimizing for CAC/LTV ratio misleading?

A commonly accepted benchmark suggests that the Cost of Acquisition (CAC) to Lifetime Value (LTV) ratio should be 1/3, implying you should spend up to one-third of your LTV on acquiring a customer. Seems reasonable?

But suppose you’re a B2B subscription business with a customer lifetime of 9 years or more (which is more common than not). This means it will take you 9 years to realize the full LTV. Furthermore, for each new customer, you’re:

- Applying retention assumptions that are based on data that are 8 years old.

- Assuming that every acquisition channel yields the same customer tenure.

If you spend one-third of your 9-year LTV on the acquisition, it will take three or more years to recover your initial investment (LTV is usually not evenly distributed, with most of the value loaded in later years). Where will you get the funds to sustain your acquisition efforts during these three years? In the past, many businesses could raise more capital because it was… cheap. However, this isn’t a viable option in the current downmarket.

The payback period is a superior metric.

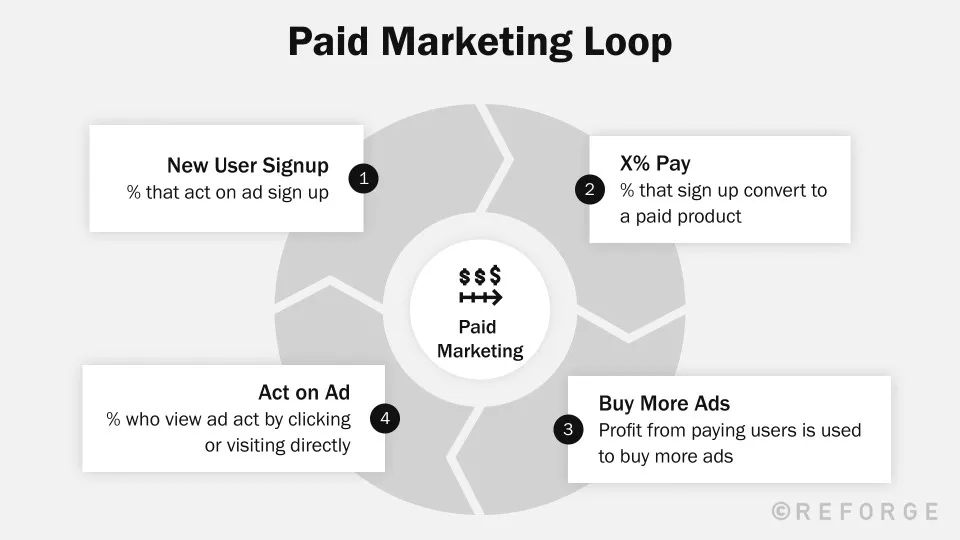

The payback period metric measures how fast and long it takes to recuperate your acquisition costs so you can reinvest returns into the paid acquisition loop.

But there is even more goodness – any revenue made post-payback period is profit that can be reinvested into other growth loops or product development strategies.

The payback period separates acquisition loops from funnels.

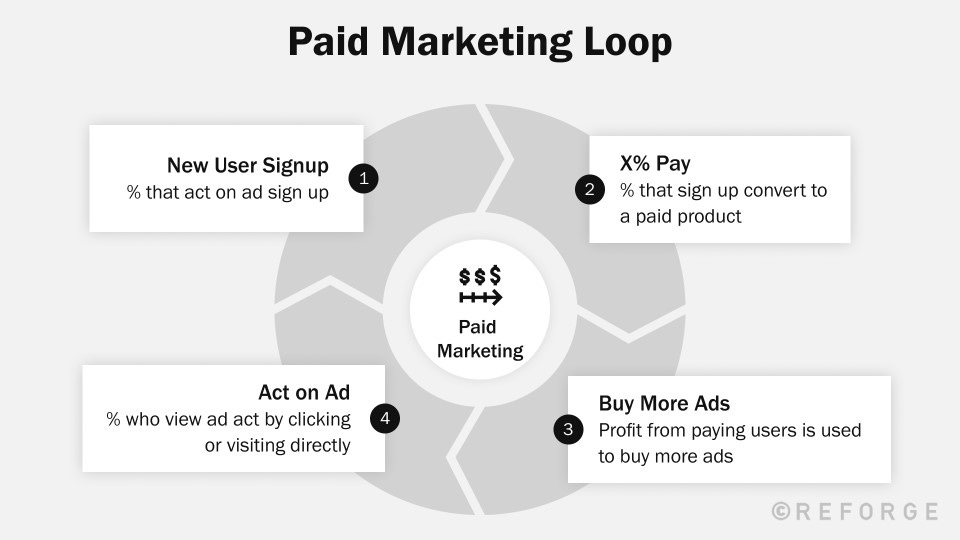

The payback period can be optimized by:

- Reducing CAC

- Increasing paid conversion rate

- Increasing ARPU (average revenue per user)

- Reducing paid conversion time

Yes, we do have CAC reduction here! But we are not focusing on it blindly. We are pulling all levers to improve our ROI, diversifying our chances for success. Levers 2-4 are focused on product performance improvement, which means we are:

- Holding product accountable.

- Tracking acquisition through paid conversion events.

- Analyzing the payback period for each channel, cohort, and use case separately.

- Segmenting our acquisition against the ideal customer profile that we are willing to spend more money on.

- Collaborating with Success, Support, and Products to drive better return on the investment.

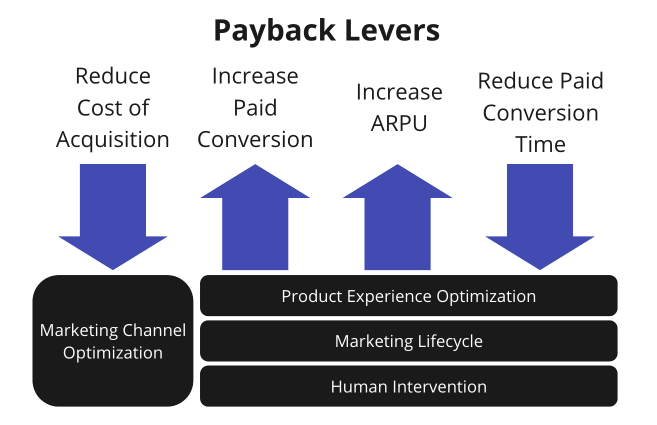

What is a good payback period?

has an excellent post on the topic.

In summary, the good payback period for B2C is <3 months and B2B <8 months.

This means you can return your acquisition investment in that payback window to reinvest it back into acquisition. Which is what separates the growth compounding loop from a leaky funnel.

Afterword

CAC is an important metric. But the payback period is a superior metric for acquisition focus that:

- Doesn’t only focus on marketing channel optimization.

- Keeps product, sales, support, and success teams to monetize the customer.

- Creates acquisition loops.

- Laser focused on the velocity of the ROI

May the short payback period be ever in your favor.

Other resources:

- Great post to read on the topic from Stage2 capital.

- If you are Refoge member, this lesson on ROAS (return on ad spend) is fantastic.