by Jim Everhart for MarketingProfs

Marketers, by now, are well-versed in the customer journey. And for good reason: being aware of the twists and turns a customer takes on the way to a sale is incredibly instructive—not to mention sobering, even humbling.

Awareness of the customer journey is a constant reminder that all those prospects out there aren’t waiting with bated breath for your next great announcement. Every message, social media post, product release, email, and ad is fighting for your audience’s attention.

But knowing the other side of the story, the buying process, is equally important for good content marketing.

But wait—Isn’t the buying process the same as the customer’s journey?

Not exactly. They are related, but they are not the same thing.

The customer journey follows a potential buyer through their various travails and travels—the ups and downs of their media consumption and personal journey from research to discovery to consideration and decision.

The buying process places that person’s path in the context of the buying team and the company. Thus, it gives us insights that are essential for the marketing and sales process:

- Who else is on the sales team?

- What roles do each of the team members play?

- What information do they need?

- Who is calling the shots?

- How is the ultimate decision being made?

What’s more, in situations with two or more key players—all with their own buyer’s journey—a single buying-process visualization maps them both, and it gives you some understanding of how a buying decision is made in your targeted company.

Many have described the B2B buying process, but when you’re building a buying-process map from the ground up, visualizing is easier—and, ultimately, easier to understand.

The ‘Basic’ B2B Buying Process

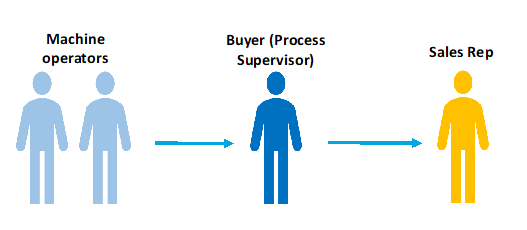

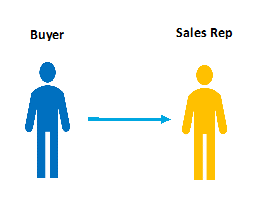

We’ll start with the most basic transaction. There’s a buyer and a seller, usually a sales rep from your company. It might look like this:

If it were always that simple, you could move on to the next topic in your agenda and forget about this exercise.

Alas, selling these days is rarely that simple, especially in B2B marketing, where the growth of the buying team is now the stuff of legend. I’ve written previously about the buying team’s having to meet in a minor league baseball park. Or having more characters than Game of Thrones.

The goal is not to clutter this map with additional players, but to help content marketers understand who is doing what.

So, who are those other players?

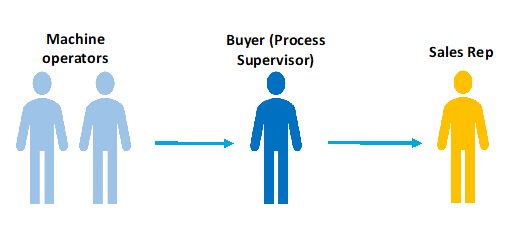

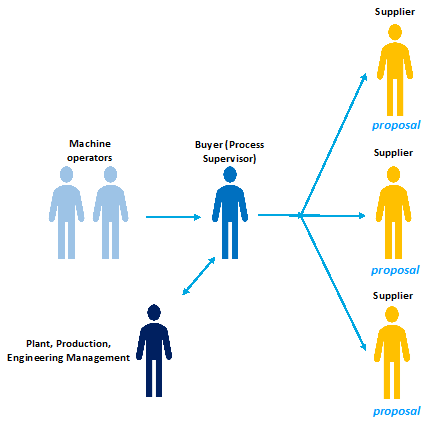

First, a buyer, especially in an industrial setting, usually has a team of coworkers. A process supervisor, for instance, might have several workers who operate stations or machines in that process. They might be the people who alert their supervisor that a problem is occurring in the line. It might look like this:

The buyer will want to keep the team closely involved throughout the entire process for two reasons. First, the team members were the ones who discovered the problem and understood the implications it had in the process, so they will have good insight into possible solutions. And second, the team members will most likely be responsible for implementing any changes. A smart supervisor will want to give them a sense of ownership of any “solution” that comes out of the process.

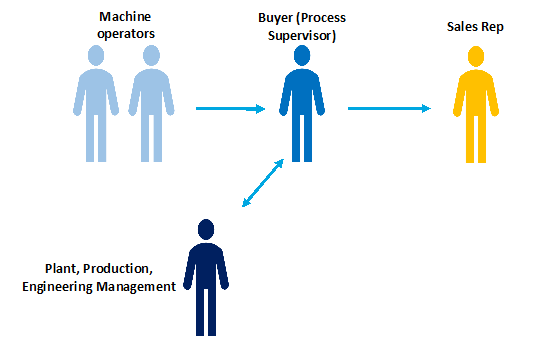

In the same way, the machine operators can’t simply pull the trigger and authorize the purchase. Our buyer, the process supervisor, can’t either. They have a reporting relationship with at least one direct manager and possibly a series of plant, production, or engineering management reports.

To keep the chart from getting too crowded, we will use one figure, knowing there could be several layers depending on the company and the size of the purchase.

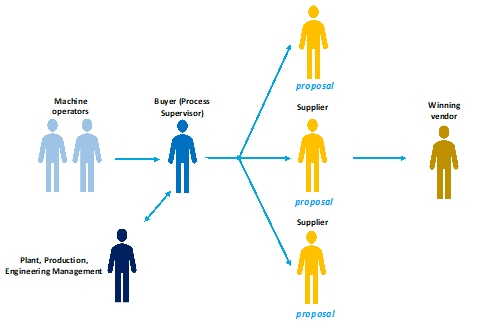

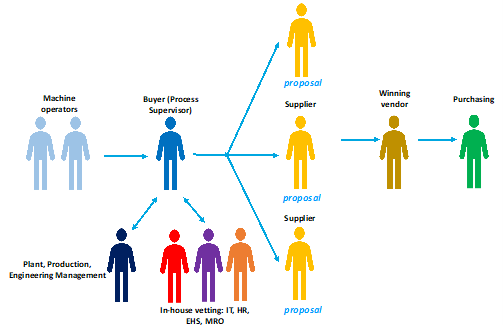

So, buyers and their teams research a lot of possible solutions, usually by going online and coming up with varying approaches to the problem, then settling on a single product or technology solution. They begin to research some potential vendors and develop a group that appears to be qualified. All are given the opportunity to submit proposals.

The company selects the winning bidder, and we’re finished, right?

Not so fast. There are at least two more steps involved.

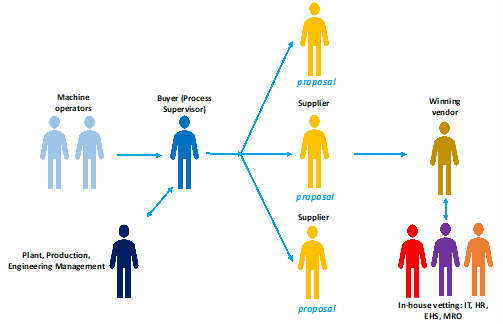

First, the winning proposal needs to be vetted by a team of in-house experts. Depending on the company and the technology required, the list of experts can be extensive:

- Information Technology (IT) will need to review any proposals to prevent security breaches and ensure the proposed solution will work well with the company’s IT infrastructure.

- Human Resources (HR) will need to review the proposal to determine whether any new skills or training are required, and whether additional hires will be needed.

- Environmental Health and Safety (EHS) will want to address safety issues and ensure the proposed solution advances the company’s sustainability efforts.

- Maintenance and Repair (MRO) will have to determine whether additional maintenance is required and whether the current team has the skills needed.

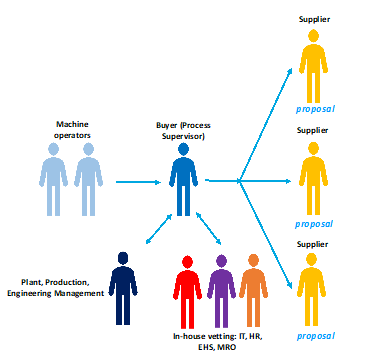

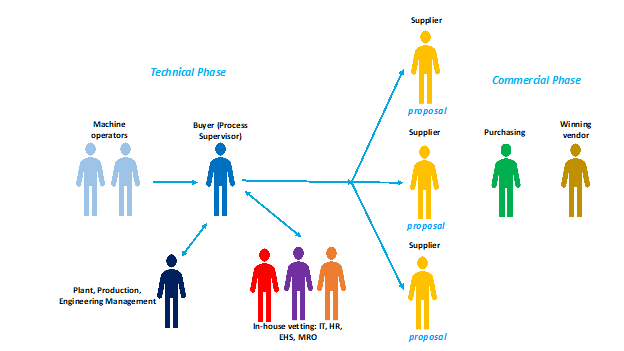

In some companies, the in-house experts are drawn in before the bids are submitted, making the map look more like this:

And, as implied earlier, we’re still not finished. The winning vendor is often required to work with the company’s purchasing people to work out the details.

Sometimes, it’s relatively simple, and the winning vendor agrees to a schedule of payments and deliveries to match the company’s requirements.

But in some companies, especially larger international firms, the purchasing function becomes an entirely new phase of the process, a “commercial phase” that contrasts with the “technical phase,” or everything that has transpired thus far.

In those situations, the purchasing function takes over the final proposal process, engaging with the vendors to extract the most favorable terms—usually the lowest price.

Naturally, there are almost an endless number of possible variations. But mapping out the players and sorting out their relationships is extremely useful.

How to Use This Insight

Although a buying team is large, it is not an unruly mob. Some rules and relationships circumscribe the team’s activities and define how the team does its work.

The bottom line: its members are not all equal. Some have a supportive role, which requires only that they be made aware a change is coming. Others can make suggestions or offer guidance.

Decision rights, however, will be limited to one or two players—most likely the project initiator and their direct reports.

Color-coding helps group the members of the team:

- The players in blue are your team members and supervisors. They need access to most of the project information that you have.

- The multi-colored group at the bottom center is your in-house vetting team—allied co-workers who primarily need to know how your proposal affects their area.

- The green player on the right represents the purchasing group, the true wild card with an influence that varies from company to company.

Knowing the players will inform your communications to the various members. Because not everyone needs to know everything: HR may not care about cost; IT may not need to know about maintenance requirements; MRO won’t be interested in IT protocols.

Diagramming the B2B buying process helps define who does what, who needs to know what, and whose job is on the line.