by MARK DANCER for Mark Dancer on Innovating B2B

The integration of renewable energy sources into the electric power system is revolutionizing the energy landscape, and electrical distributors are at ground zero—but the design and operation of the value chain for electrical products is uncertain and evolving, without a coherent vision. The National Association of Electrical Distributors (NAED) has stepped up, creating the Futures Group to explore the future and Office Hours to engage distributors, suppliers, contractors, startups, vendors, and communities in a thoughtful conversation and collaboration. I am thrilled to support NAED’s effort. This edition shares our first annual report on progress and plans, with insights for every industry and line of trade. I invite you to watch this video on the future of technology and the supply chain, read our report, and share your ideas and experiences.

Exploring the Future of Electrical Distribution

A report on progress and plans from the NAED Futures Group and the Office Hours team.

Futures Group members:

Paul Kennedy, Dakota Supply Group (Futures Group Vice President)

John Harman, Kendall Electric

John Kerkhove, Horizon Solutions

David Rosenstein, Connexion

Franklin “Sully” Sullivan, ABB

Scott Teerlinck, Crescent Electric Supply Company Bill Waltz, Atkore

Contributing Staff:

Ed Orlet, Mark Dancer, Jennifer McKinney, and Gail Reynoso

INTRODUCTION

Futures Group Vice President Paul Kennedy

NAED has been a trusted source of best practices for decades. Our staff and volunteer leadership are engaged daily in trying to help you be more effective now. One area where NAED, and our industry generally, have not been as effective is thinking about the future. Before COVID changed everything in 2020, NAED’s Board created a new leadership group to replace our Regional Councils.

NAED’s Futures Group is an impressive list of industry leaders with one job: to have exciting conversations about our industry’s future. The way we curate those conversations has evolved over the past few years. COVID made meeting in person impossible for much of our first 18 months. Our early work on the customer of the future set a solid foundation. However, we learned that the legacy association practice of task forces creating white papers was not generating the volume of discussions we wanted.

In late 2022, the Futures Group pivoted to a new model of leading conversations about the future. We call it Office Hours, and our staff studies a different facet of our industry’s future every month. We talk to experts via podcasts, then bring those experts to live Zoom-based networking discussions where our members can speak with them. What follows in this report is our look back at the first series of podcasts and a look ahead at what conversations are coming next.

I have been proud to serve as Vice President of the Futures Group during this challenging time. As my term expires and I pass the gavel to Scott Teerlinck, I want to thank the past and current members of the Futures Group and welcome our new members. Your engagement and involvement continues to chart the course for our future.

Current Members: John Harman, Kendall Electric; John Kerkhove, Horizon Solutions; David Rosenstein, Connexion; Franklin “Sully” Sullivan, ABB; Scott Teerlinck, Crescent Electric Supply Company; Bill Waltz, Atkore.

New Members: Mason Coudron, Dakota Supply Group; Aleshia Eckard, Siemens; Farrah Mittel, Schaedler Yesco Distribution; Neil Rabi, Eaton; Kathleen Shanahan, Turtle & Hughes; David Tozi, WESCO; Katheryn Williamson, Crawford.

Past Members: Steve Bellwoar, Colonial Electric; Steve Blazer, Blazer Electric Supply Company; John Cain, Wiseway Supply; Chris Scarbrough, Springfield Electric; Darrell Smith, IAC Supply Solutions, An Agilix Solutions Company

Paul Kennedy

President & CEO, Dakota Supply Company

Chairman, NAED Futures Group

OUR CHALLENGE AND OPPORTUNITY

Why should an already successful business radically reimagine its business model? So much of what we hear about the future calls for us to innovate and change. Leading firms in our industry are leaders because they are very good at doing what they do and have been over long periods. These companies grow. As companies grow, changing becomes more time-consuming, expensive, and dangerous. We are familiar with the stories of companies like Kodak or Blockbuster; companies that didn’t change and became shells of themselves. How many Kodaks have we seen in electrical distribution? No such case study comes to mind in our industry.

This is the foundational challenge facing NAED’s Futures Group. Our leading companies aren’t leaders because they radically changed their business model. They’re leaders because they out-execute their competitors and provide customers with a reliable source of material, services, and support at a fair price and faster than 2-Day Prime Delivery. We have heard the cries of “wolf” many times. We have faced existential crises from online retailers, auction sites, home centers, and — if you look far enough into the past — kitchen appliance retailers. We’re still standing.

We can be forgiven if we seem a bit weary of people without track records telling us that we need to run our businesses entirely differently than we have successfully done for decades.

But what if this time is different? We live in epic times marked by the emergence of generative AI, ongoing digital transformation, growing geopolitical competition, a supply chain struggling to be more resilient, and a generational transformation unlike any other. What if disruptive threats are real, and we are not prepared? Or, what if game-changing opportunities are real, and we let them pass us by? Distributors are not wired to invent radically new things, not even the largest. Is this a blind spot? Does it matter? Can NAED help? Should we push? Should we focus on our entire membership or just the members that are curious and open to doing business differently? Are we pushing a rock up a hill or rolling toward the inevitable?

The Futures Group’s responsibility is to call attention to the range of possible futures for our industry. We are challenged with creating novel and thought-provoking content while honoring the strong pragmatic streak that runs through the heart of our membership. But this is not our responsibility alone. We are attempting to light a fire to encourage our members to discuss what they are not.

This report summarizes what we have learned and describes our approach to helping our members explore the future.

JUST THE FACTS

We have made significant progress in the last six months. We have conducted seven Office Hours and planned our next seven. Each Office Hours is preceded by a guest interview published as a podcast and a newsletter article introducing key concepts and questions.

We are tracking metrics and working to understand the data. Activity and traffic to The Futures Group webpage is consistent with other NAED content but is more consistent over time. We’ve seen a slowdown in registrations for Office Hours networking sessions.

WHAT WE’VE LEARNED

About Industry Change and Member Mindsets

Our industry is transitioning, reshaped by technology and social forces, on a national and global scale, creating epic opportunities and challenges. As leaders, you know this, but a quick review is helpful:

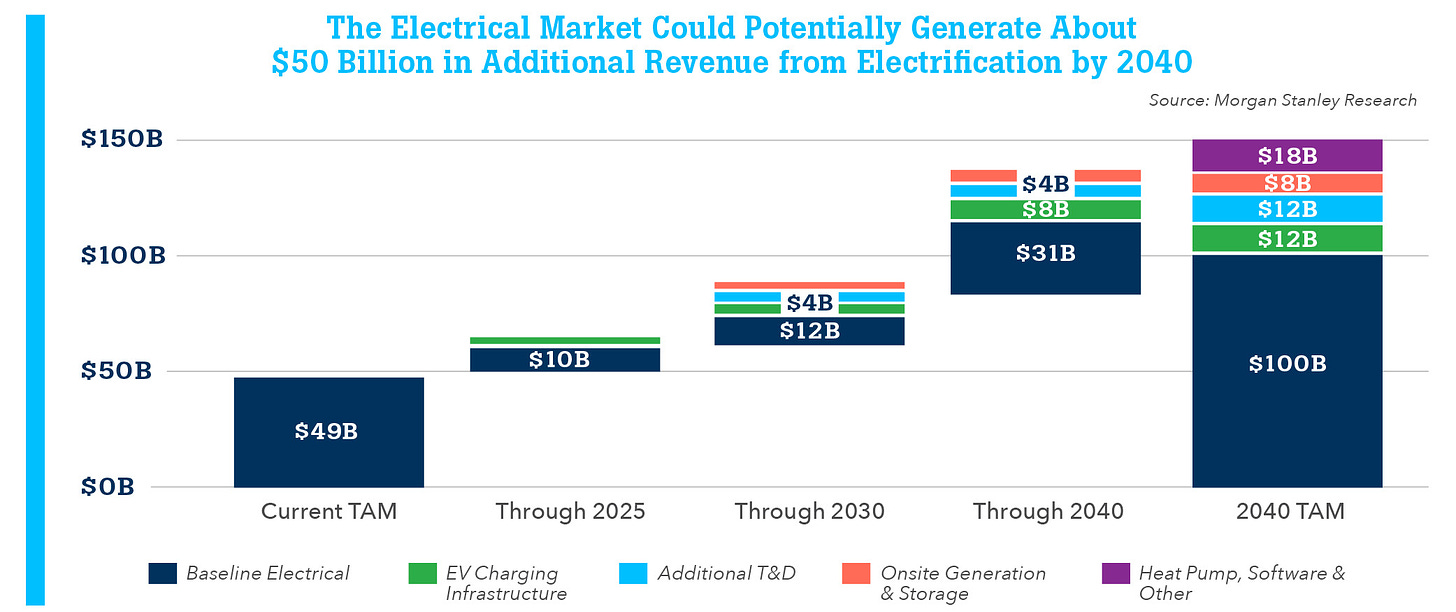

- Electricity. The future of electricity is defined by electrification, renewable energy, distributed power, and decarbonization, creating opportunities for selling new products and services. Morgan Stanley estimates the electrical market could generate an additional $50 billion from electrification by 2040.

- Generational transfer. Unlike any other, we are undergoing a generational transformation, defined by the mastery of the internet as a source for gathering information, making connections, and solving problems. The World Bank estimates that the number of working-aged Americans will decline by more than 3% over the next decade. Skilled labor will be in short supply for the foreseeable future and the best younger workers will demand more flexibility and work-life balance from their employers.

- Supply chain. Geopolitical rivalries are reshaping the supply chain as national security interests call for protecting our dominance in the technology sector and ensuring a supply of critical raw materials.

- Generative AI. Generative AI is rolling out at unprecedented speed, reshaping media and software in every consumer and business application, with the potential to massively change how we interact with customers, manage our business, and drive innovation.

- Digital Technology. Digital transformation is underway, marked by the growing importance of mastering data capabilities for running our businesses, selling online, and using AI for smart pricing, guiding purchases, and directing sales activities. Mindsets shift as changes unfold, providing a glimpse of intent and potential conflicts.

Supplier/distributor mindsets

Some manufacturers are assuming tasks traditionally performed by distributors — servicing customers directly (DTC), acquiring or leveraging disruptive startups and marketplaces, and leveraging AI to predict demand and better manage the supply chain. Distributors are making similar gains, no longer acting simply to fulfill demand but launching customer services that influence brands, plan and prompt purchases, and assemble or manufacture products. Change is happening – fast and slow, seen and unseen.

Supplier actions may impact distributor revenue or margins, but the immediate challenge is the impact on customer attitudes, preferences, and behaviors. Customers need knowledge and will always seek the best advice and support in a manner that is appropriate for the need at hand

and available most conveniently or productively. Customers value interactions with distributor salespeople less, especially when meeting in person. As suppliers and distributors pursue digital commerce, we must explore modern methods for measuring and tracking “customer relationship equity” as individual companies and collectively as a channel.

Generational mindsets

The generational change already well underway exacerbates the tension between a storied past and an uncertain future.

- Senior generations. The pragmatic streak that runs through the leadership of our industry has always favored “fast followers” over the “bleeding edge.” But this mindset is less prominent among our largest and some smaller distributors, who have always “punched above their weight.” The challenge for forward-looking small and midsize distributors is their lack of scale for industry-changing innovations. However, their ability to change more quickly than large distributors means they can still succeed.

- New generations. The emerging generations of distributor employees — the inheritors of our industry — reckon entrepreneurship differently. In fact, according to the Family Firm Institute, family businesses that started before 1990 had a 30% sell-off rate. A family business started since 1990 has a 40% sell-off rate. PwC found that only 35% of millennials are interested in running the family business — compared to 62% of baby boomers. For some, it’s a place to work. For the innovative, there is no framework for making distribution a modern, attractive business, and senior generations are in a place in their career where they are naturally risk averse.

A FRAMEWORK

For Guiding Our Explorations

As our industry changes and mindsets shift, sales effectiveness is top of mind for members. Improving sales effectiveness typically involves redefining inside and outside sales roles, adopting AI tools, and implementing an omnichannel structure for a seamless customer experience.

In our conversations, we push for a more strategic response, challenging members to think beyond improving sales effectiveness to consider adjustments to traditional electrical distributor business models. We need a framework for guiding our explorations, and we have adopted Osterwalder’s Business Model Canvas:

We expect multiple themes to emerge as we explore potential business model changes. Many members will resist change, avoid significant investments, or gradually tweak their model. More proactive members are already embracing digital commerce and focusing on delivering new or improved customer experiences. There is a general agreement that business model innovations around data, analytics, and artificial intelligence are coming. Business model evolutions must also reflect values around safety, sustainability, wellness, and purpose that speak to the emerging generations in our workforce. As distributors, we will remain local businesses, and some innovations may involve recentering on communities and working in the real world with customers.

Already, our explorations around business models have yielded several areas of uncertainty, often perceived as barriers, pointing to questions we must investigate:

- Scale. For decades, acquisitions have been distribution’s dominant method for growing sales, shares, and profits. Scale delivers a competitive advantage, and we expect that large and growing distributors will continue to invest in technology, operational effectiveness, and sales and marketing execution. But what does the future hold for smaller distributors? Is technology a democratizing force, offering tools for small and large distributors? Will a platform emerge to allow smaller distributors to band together to adopt state-of-the-art technology? Will successful innovations increase the importance of organic growth by distributors, large and small?

- Non-traditional models. New companies seeking NAED memberships are not cut from the same mold as traditional electrical distributors, including companies offering electronics products or operating marketplace platforms. What is the impact of a more diverse member base? Will competition increase? As the pool of larger acquisition targets dwindles, will non-traditional models become attractive targets for larger distributors to use as innovation laboratories? Will we see more mergers between electrical and distributors from adjacent trade lines (HVAC, plumbing, electronics)?

- Digital technologies. Today, members mainly adopt digital technologies because they are driven to stay current or catch up instead of fitting technology to a new purpose or competitive strategy. What will be the defining characteristics of NAED members that use technology to create sustainable competitive advantage?

- Channel strategies. Manufacturers have a multitude of pathways to market, and customers have unprecedented choices to access the material. A consolidating industry means there are larger firms with more leverage all throughout the supply chain. Leading firms will have more leverage over their channel partners. How will these changing channel dynamics impact the historical relationship between distributors, their suppliers, and their customers?

- Culture and capabilities. COVID brought the topic of corporate culture to the forefront in American business. Whether discussing remote work, onboarding, flexible schedules or employees’ physical and mental health, distributor leaders have been grappling with a changing workforce. How can members maintain their cultures, in many cases developed over generations, in a time of changing workforce expectations?

BUILDING

On Progress and Aiming for Impact

Going forward, we suggest two priorities strengthening our Futures Group Office Hours program: Deep explorations within three essential topics and multimodal methods for increasing member engagement.

Essential Topics

NAED’s Futures Group has started a conversation about where our industry is headed. But we have only started the conversation. Three topics resonate with our audience and require deeper explorations across multiple Office Hours:

- Digital capabilities and technology. What are the most impactful technologies for distribution and the supply chain? Which technologies pose opportunities for innovation, and which pose threats of disruption? What capabilities are required to make progress now and prepare for the future?

- Talent and innovation. How can distributors recruit, develop, and retain the talent required for innovation, including leaders, managers, professional staff, and skilled workers? Can distributors leverage outside resources to fill gaps, develop competencies, and leap ahead?

- The future of electricity and channels. How will customers and channels evolve as electrification, renewable energy, distributed power, and other trends reshape electrical markets? Can distributors lead the transition?

Finding, selecting, and recruiting guests with consequential knowledge, experiences, and ideas is essential for creating the best possible Office Hours discussions. We are expanding our search for guests. Our recruiting methods include:

- Networking with members, suppliers, and customers

- Searches on podcast platforms, through academic institutes, and generative AI (e.g., ChatGPT.)

- Leveraging the NAED brand and reputation as an industry “in the middle” of electrification and related trends

Member Engagement

For the Future Group’s work to achieve a higher impact, we need to challenge ourselves and our industry peers to have more uncomfortable conversations. This may come at the expense of popular/broad audience participation. While some of our topics, like electric vehicle adoption, reached a broad audience, the appeal of others—like smart contracts in construction—were decidedly “niche.” That’s okay. In fact, we may judge our effectiveness by how many topics we bring to the industry that are not already the subject of weekly webinars from other organizations.

We are building a purpose-driven media platform through our Office Hours, podcasts, and articles. Our goal is to spark consequential conversations and generate new ideas for immediate and longer-term execution. Ongoing success requires that we invest and strive to improve around two dimensions:

- Media execution. Core competencies include selecting the right topics, attracting strong guests, and fostering an engaging conversation including audience participation. We are researching best practices for media execution, looking for experts like PRX, a media company specializing in audio journalism and storytelling with services that include podcast design, education, consulting, and hosting.

- Interest and engagement. We are working to improve awareness and participation, focused on recruiting an audience that is curious, thoughtful, and open to doing business differently. Methods include traditional marketing and social media, direct requests to industry leaders, cross promotion with industry and outside podcasts and newsletters. Additionally, we may offer briefings for member strategy meetings or innovation retreats, field trips, study sessions, or workshops for engaging audience members, etc.