by ELENA VERNA for Elena’s Growth Scoop

There is a cute penguin mascot on Oracle’s home page… 🤯

What is this consumer-like ‘thing’ doing here if this is a traditional enterprise B2B company geared at serious enterprise buyers? Shouldn’t it all be corporate and serious?

There is a powerful consumerization trend sweeping across the B2B landscape, where business software is starting to look much more like consumer products. Colorful icons, cute mascots, emojis, friendly language, easy-to-use interfaces, and habit-forming experiences make B2B products feel like a joyride rather than a slog through the Siberian tundra.

Companies like Dropbox, Miro, Slack, and Figma are riding the crest of this tsunami with the grace of seasoned surfers, feasting on the success of this transition.

Why did B2B consumerization take off?

But what’s behind this miraculous transfiguration, you ask? It’s the rise to power of the end-users in B2B organizations! End users used to be an afterthought in B2B software development because all focus was on meeting the enterprise buyer checklist. But no more.

Enterprise buyers used to make all B2B software decisions – to control budgets, meet cross-functional requirements, and negotiate the best deals. But products they picked and pushed down onto employees kept failing to get traction:

- Just because a feature exists doesn’t mean it’s usable. End-users had difficulty figuring out how to do basic tasks and adopting functionality.

- People are not good at articulating their problems. So even if, on the surface, the product met the requirements, the requirements were often flawed in the first place.

- Adopting software someone chose for you is not as appealing as making your own decision.

This led to two things:

- Lack of utilization frustrated enterprise buyers who were ‘wasting’ money on unused products. They started turning to end-users to include them in decision-making and wanting proof of value before committing.

- End-users were left with unsolved problems and went on the quest to find solutions themselves.

Enter the era of B2B end-users setting trends and influencing (or even making) purchasing decisions. Or, at a minimum, holding a veto power. Enterprise buyers are still present, but either as enablers or partners. This led many B2B companies to focus on wooing end users first, all in the quest to dazzle their ultimate targets: enterprise buyers. This, my friends, is the premise behind Product-led Growth.

So, should B2B growth operate the same as B2C growth now?

Not quite. Although they might start looking the same on the interface (cute penguins, anyone?), there are three key differences in how growth teams at B2B and B2C businesses function across:

- Revenue sources

- Revenue concentration

- Account vs. user focus

Let’s dig in!

Difference 1: Revenue sources for B2B and B2C

While most growth teams focus on growing revenue through acquisition, one key distinction between B2B and B2C growth is their approach to existing customers.

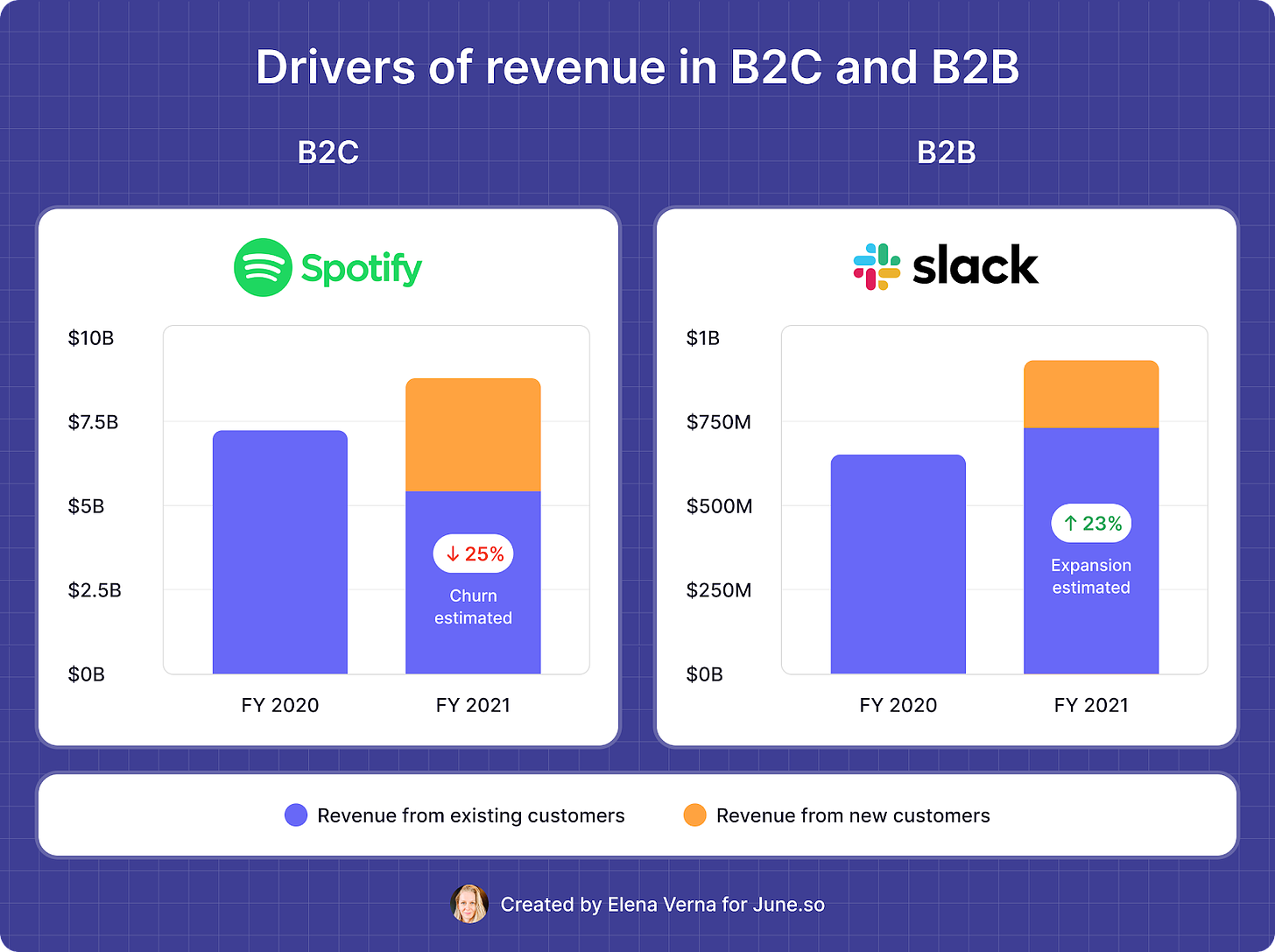

Existing paid customers can renew at the same amount, churn, go through contraction (reduction in renewal amount), or expansion (increase in renewal amount). To understand the difference between B2B vs. B2C approaches, let’s look at the most important metric in existing revenue: Net Dollar Retention (NDR).

What is NDR?

NDR is calculated using this formula:

For example: A business starts the year with $500,000 in annual recurring revenue. Over that year, existing customers upgrade their subscriptions for $100,000 more recurring revenue. Other customers decide to downgrade, causing a reduction of $30,000. Then there are a few who decide to stop their subscriptions altogether. That comes to $10,000 in revenue churn. Plotted into our above NDR formula, the equation becomes:

($500,000 + $100,000 – $30,000 – $10,000) / $500,000 x 100 = 112% NDR

That year, the existing business grew by 12% ($60,000) in ARR from the customer base they started the year with.

NDR > 100%: This means that the revenue generated from existing customers is expanding, and revenue grows even if you don’t acquire new customers. In other words, the existing user base is key to your overall revenue growth.

NDR < 100%: The company is experiencing shrinking revenue from its existing customers and must get new customers to compensate for the loss of its existing user revenue base.

The fastest-growing businesses in the world all have NDR > 100%: They diversify their revenue growth across new and existing customers.

Best-in-class NDR rate is > 120: Even if a business doesn’t get new customers, its revenue grows over 20% year-over-year, which is fantastic! For example, Snowflake and Twillio NDR were 138% and 155% when they went public.

NDR expectations for B2B vs. B2C

In B2B, the Net Dollar Retention rate is expected to be greater than 100, meaning that revenue growth comes from both new and existing customers. However, in B2C, it is accepted for the NDR < 100 due to the price-sensitive nature of consumer products. This means that businesses in the B2C sector need to focus a lot more on acquiring new customers to grow their revenue.

For example, Slack’s Net Dollar Retention rate is 120%: for every dollar a business spends on Slack in one year, it will spend an additional 20% on Slack the following year. This is due to businesses upgrading their plans or adding more users to their Slack accounts. As a result, Slack has diversified revenue growth streams and is less dependent on acquisition performance—a good place to be!

Spotify’s net dollar revenue retention rate is ~75%. This means that even if they have expansion, churn and contraction overtake that number, leading their existing revenue to shrink constantly. They must keep acquiring paying customers to make up for existing revenue bleeding, meaning they have put enormous pressure on new revenue to compensate for this loss. This is because consumers are more likely to cancel their Spotify subscriptions than businesses are to cancel their Slack subscriptions.

Source: Spotify and Slack’s S1

Difference #2: Revenue concentration

For B2B, most revenue comes from a few accounts. In B2C, revenue is evenly distributed across the user base.

For example, Slack has 600,000 customers, but 40% of its revenue comes from less than 1% of its customers. Indeed 575 pay more than $100,000 a year for the service*. Conversely, in B2C, revenue is fairly evenly distributed across the entire customer base.

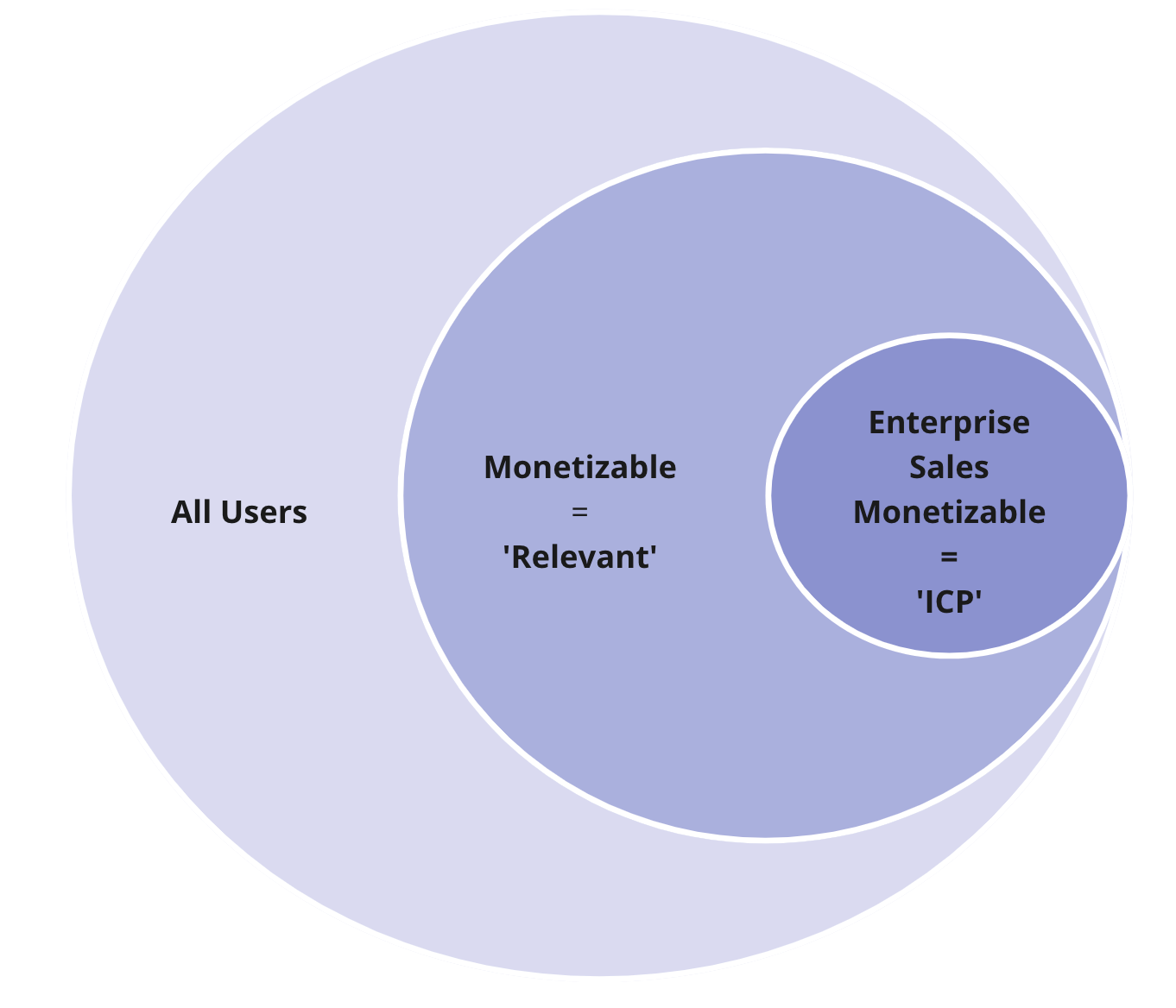

For a B2B, it’s crucial to identify these high-revenue opportunities as they come through the door. This means profiling and identifying the most promising accounts as they sign up. Every sign-up in B2B has to be profiled into:

- Ideal Customer Profile (ICP): These high-potential accounts should *eventually end up* with enterprise contracts through sales. Giving them a human point of contact to streamline their experience is beneficial and necessary. This is where most of the revenue will come from.

- Monetization relevant: These sign-ups will be monetized through the self-serve option. They won’t be able to hit the sales floor due to the nature of their segment. These are often called prosumers in B2B.

- All other users: These sign-ups use products for personal reasons. They are students, non-profits, or any other persona you won’t monetize because they will never convert to paid.

ICP is most frequently determined by the company size of the sign-up, as monetization potential increases with the size of the business. The most frequent ICP thresholds are 200+ employees businesses with the sign-up having work intent.

Difference #3: Revenue comes from accounts, not users

In B2B, you sell to accounts, not individual users. In B2C, you sell directly to users. For PLG B2B, it’s essential to approach metrics from a team perspective rather than an individual one. New accounts acquisition, engagement, retention, and expansion are the new standard metrics.

For B2B acquisition, new accounts (not users) is the most important metric. New users are also important, as it measures the velocity and spread within the account, signaling the viability of the enterprise deal potential. And let’s not forget about those finicky enterprise buyers!

As a result of this account view, in B2B, the acquisition process operates on three distinct tracks:

- Gaining the initial end user within the account. Securing the initial end user is always the primary objective, as it sets the first point of contact with the account.

- KPI: New team creations

- Attracting team members. Bringing team members on board is vital to pave the way to an enterprise deal (no one invests in an enterprise contract solely for single-user value).

- KPI: Users per team

- Finding a buyer. Winning a buyer is an entirely separate challenge. Buyers aren’t found in the same channels as end users (think LinkedIn, G2, Capterra, Events, Forrester) and require an enterprise-level value proposition (different from the end users).

- KPI: Pipeline creation

Each track possesses distinct CACs, channels, tactics, messaging, and velocities. Merging them leads to mediocre results. The goals across these tracks fall on the different teams: Growth marketing/product teams typically handle #1 and #2, while enterprise marketing teams handle #3.

B2B teams also need to define and measure activation and engagement on the account level. It is important to incorporate growth-within-account activation metrics to ensure a successful path to expansion. For example, the activation metrics at Miro and Slack are based on ‘Collaboration between 2 or more team members.’ It is a trap to optimize activation on the individual user level in B2B, as it will lead to individual usage that will not translate to successful expansion.

To summarize

End-users drive the consumerization trend rise in B2B organizations. End-users are now setting trends, influencing, or making purchasing decisions, leading to many B2B companies focusing on wooing end-users first.

While B2B and B2C products may start to look the same on the surface, there are three key differences in how they function under the hood:

- Revenue sources: B2B companies rely on a few large accounts for most of their revenue. In contrast, B2C companies have more evenly distributed revenue.

- Revenue concentration: B2B companies must identify and focus on their high-revenue opportunities, while B2C companies can focus on acquiring new customers.

- Account vs. user focus: B2B companies sell to companies or accounts, while B2C companies sell directly to users.

For B2B companies, the key to success is to focus on acquiring new accounts, engaging and retaining users within those accounts, and expanding those accounts into enterprise deals.